Find your perfect loan, fast

Make payment to anyone anywhere

In our interconnected world, the ability to make payments to anyone, anywhere has become not just a convenience but a necessity.

Trusted by 50+ top companies

Vehicles Financed

Satisfied Customer

Approval Time

About Us

Everyone deserves the opportunity to to live better

In today’s fast-paced world, convenience and efficiency are paramount, especially in times of urgency. Online platforms that consolidate emergency service requests into a single location are a game-changer. With a few clicks or taps, individuals can access a wide range of vital services, from medical assistance to roadside help, making it easier than ever to address urgent situations swiftly.

This centralized approach not only simplifies the process for those in need but also ensures a rapid and coordinated response from service providers, enhancing the overall safety and well-being of the community. It’s a prime example of how technology can be harnessed to provide a lifeline during critical moments.

-

No hidden fees

-

Approval confidence

-

Never hurt your credit score

Personalize Your Card And Stand Out From Crowd

Expressing your unique style and individuality is easier than ever with customizable cards. Personalizing your card allows you to infuse your personality, interests, or even a memorable photo onto it. Beyond aesthetics, it’s an opportunity to make your card truly your own, setting you apart from the crowd. Whether it’s for a credit card, Suntrust Cred card, or identification card, this personal touch not only adds a touch of flair but also makes your card easily distinguishable. Stand out with a card that’s a reflection of you, leaving a lasting impression in every transaction.

-

No hidden fees

-

Approval confidence

-

Never hurt your credit score

How It Works

Your Account In Easy Steps

We show our value by serving faithfully. Schedule an appointment with our account specialist to discuss your loan

We are available for call 24/7

Support Line

437-696-7982

Our Location

5000 Young St E, Toronto ON M2N7E9 Canada

KYC Verification

We will ask for your personal details like:

-

Your Name

-

Business Name (If applicable)

-

Prove of Address

-

Verified Phone Line

-

SSN

-

Employment Status

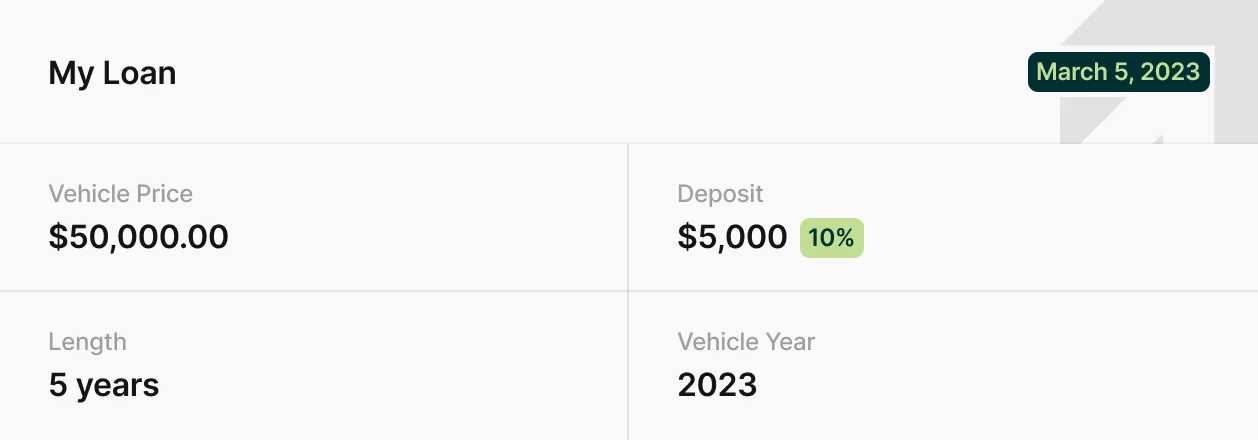

Your loan amount of:

has been approved!

Frequently asked questions

Here you’ll find answers to the most common questions about our loan services—from eligibility and documents to repayment and rates.

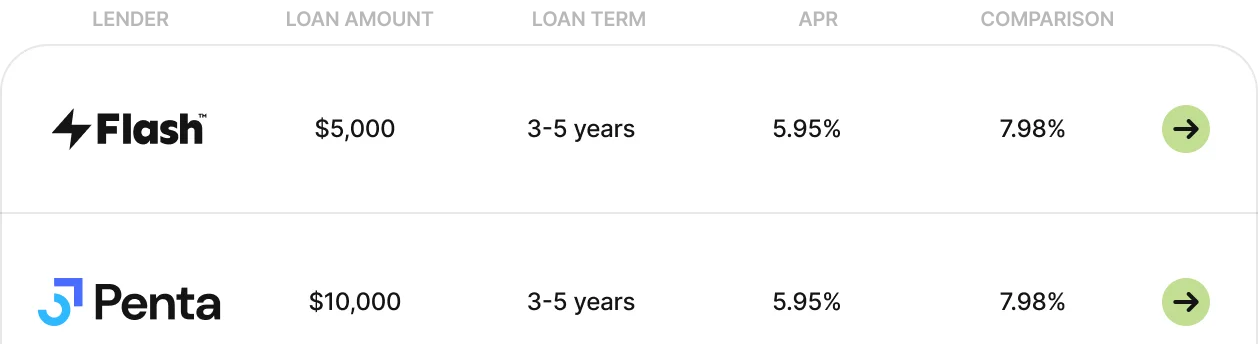

We provide a wide range of financing options to meet your needs:

Home Loans – for buying, building, or renovating a property.

Vehicle Loans – for purchasing new or used cars, motorcycles, or commercial vehicles.

Personal Loans – for personal expenses like travel, weddings, or emergencies.

Business Loans – for starting, expanding, or running your business.

Educational Loans – for tuition, accommodation, and study-related costs.

You can apply online by filling out our loan application form, uploading required documents, and submitting your request. Our team will review and contact you within 24–48 hours.

Eligibility depends on the loan type, but generally you must:

Be at least 18 years old.

Have a steady income (employment or business).

Provide valid government-issued ID and proof of address.

Have a reasonable credit score/history (though some loans may allow flexible options).

Tincidunt condimentum vivamus urna velit praesent vulputate at a viverra. Sed viverra lectus nullam est sagittis sed. Accumsan neque faucibus mattis facilisis a.

Home Loan: ID proof, address proof, income proof, property documents.

Vehicle Loan: ID proof, address proof, income proof, proforma invoice of vehicle.

Personal Loan: ID proof, address proof, income proof, recent bank statements.

Business Loan: Business registration, tax returns, financial statements.

Educational Loan: Admission letter, fee structure, guarantor documents (if required).

- Home Loans: Up to 25–30 years

Vehicle Loans: 1 – 7 years

Personal Loans: 1 – 7 years

Business Loans: 1 – 10 years

Educational Loans: 5 – 15 years (with grace period during study in some cases)

- Instant to 48 hours for personal, vehicle, and small business loans (if documents are complete).

5–10 working days for home and educational loans (due to verification steps).

News & Update

Latest From News Room

No posts found.